Oman, 9 December, 2024 : Oman and Cyprus signed an agreement in Muscat to avoid double taxation and prevent financial evasion. The agreement was signed by Nasser Khamis Al Jashmi, Chairman of the Omani Tax Authority, and Andreas Kakouris, Permanent Secretary of Cyprus' Ministry of Foreign Affairs.

The agreement aims to foster investments, strengthen economic ties, and enhance Oman’s economic standing. It also offers legal protection for investors, ensuring they are not subject to double taxes and establishing clear tax application mechanisms.

Source : www.omannews.gov.om

Related Posts

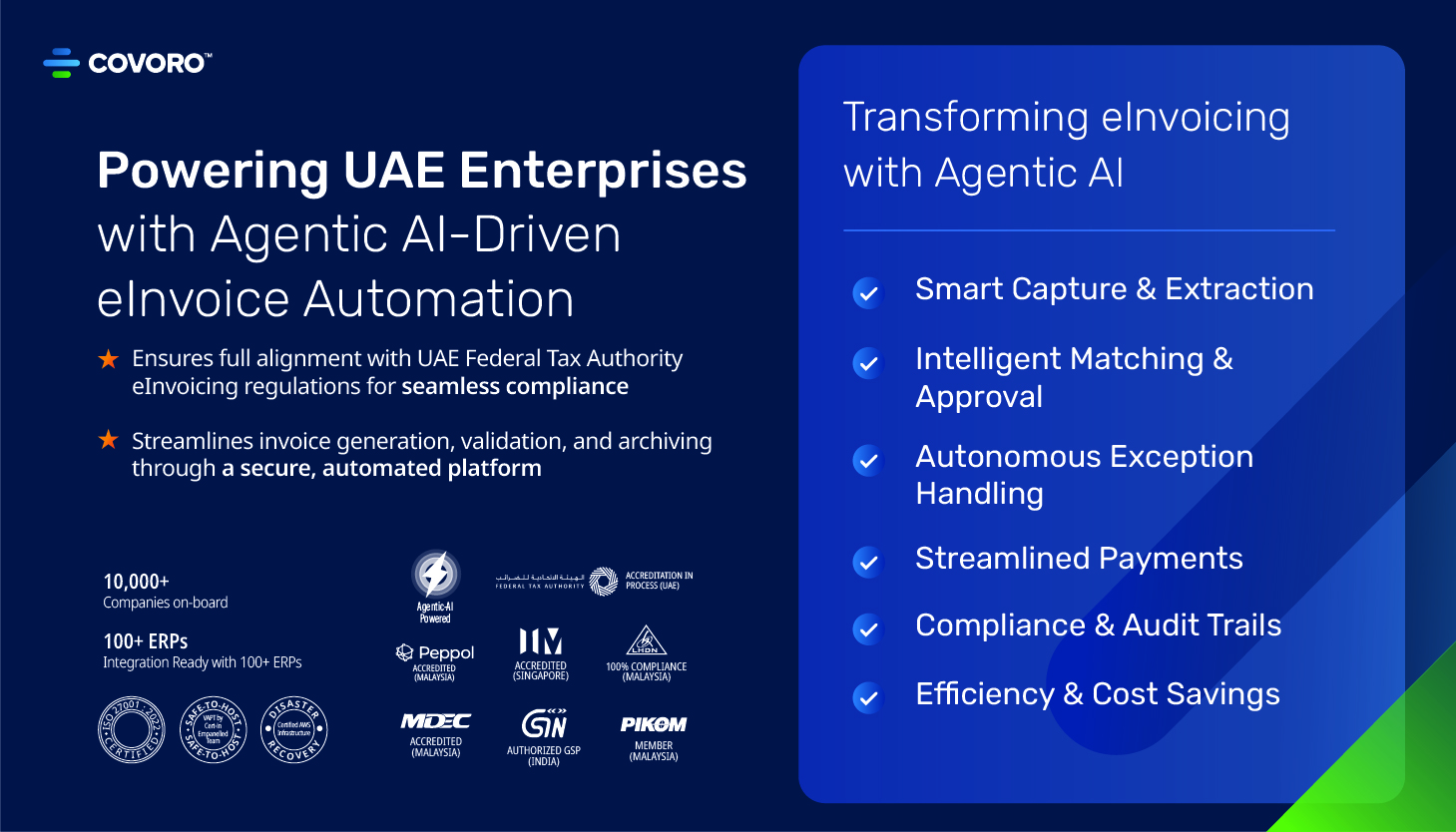

UAE, 19 September, 2025: The rollout of Corporate Tax (CT) in the UAE has introduced fresh compli...

Read More

UAE, 19 September, 2025: With the September 30 deadline for filing corporate tax returns ...

Read More

REQUEST FOR DEMOGlobally, compliance is transitioning from being a back-office requirement to a busi...

Read More